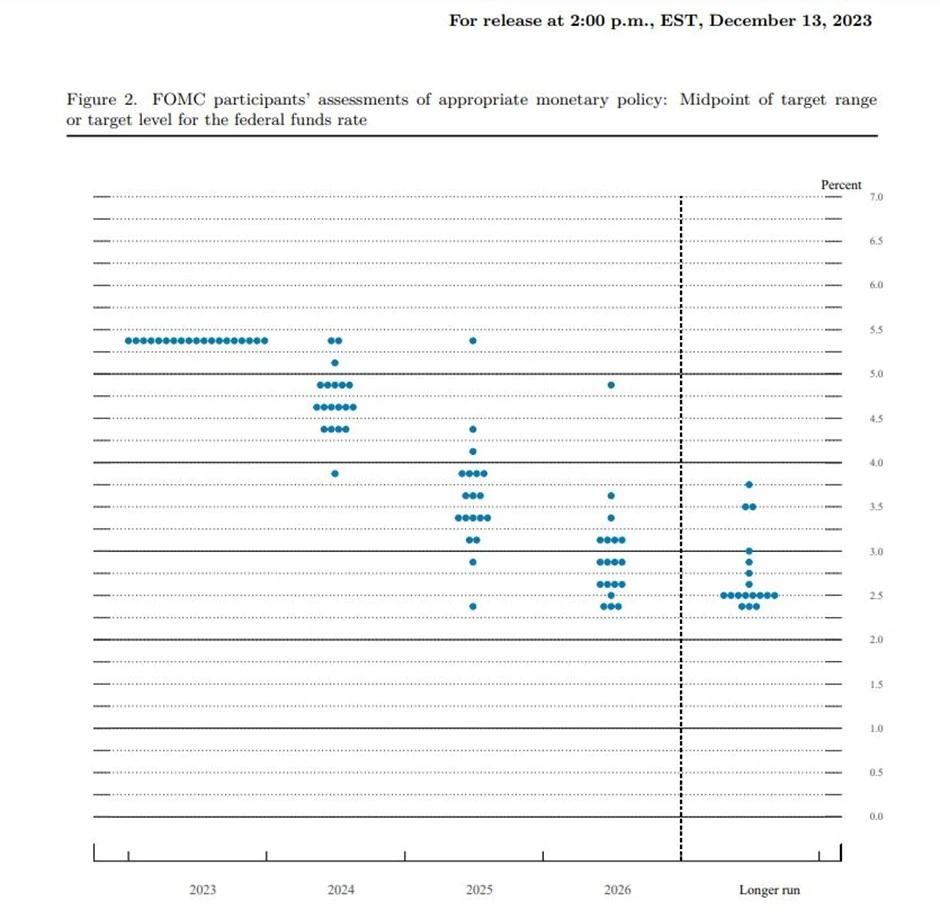

In the title of our 2023 outlook, we posed the question “Will the Fed pivot?” (see here). It may have taken 11 and a half months, but the first meaningful signs of a pivot have come. These signs came in the Federal Open Market Committee (FOMC) Economic Projections released last week. In this report, each individual member of the FOMC puts forward their projections for where they see interest rates heading. These are presented in the following “dot plot.”

In the title of our 2023 outlook, we posed the question “Will the Fed pivot?” (see here). It may have taken 11 and a half months, but the first meaningful signs of a pivot have come. These signs came in the Federal Open Market Committee (FOMC) Economic Projections released last week. In this report, each individual member of the FOMC puts forward their projections for where they see interest rates heading. These are presented in the following “dot plot.”

Source: FOMC Economic Projections, December 2023

The important points in this dot plot are that every FOMC member now believe that interest rates have peaked, and secondly, the median expectation of members next year is for 75bp of easing. Therefore, the FOMC expects that pivot that we discussed a year ago to begin in 2024.

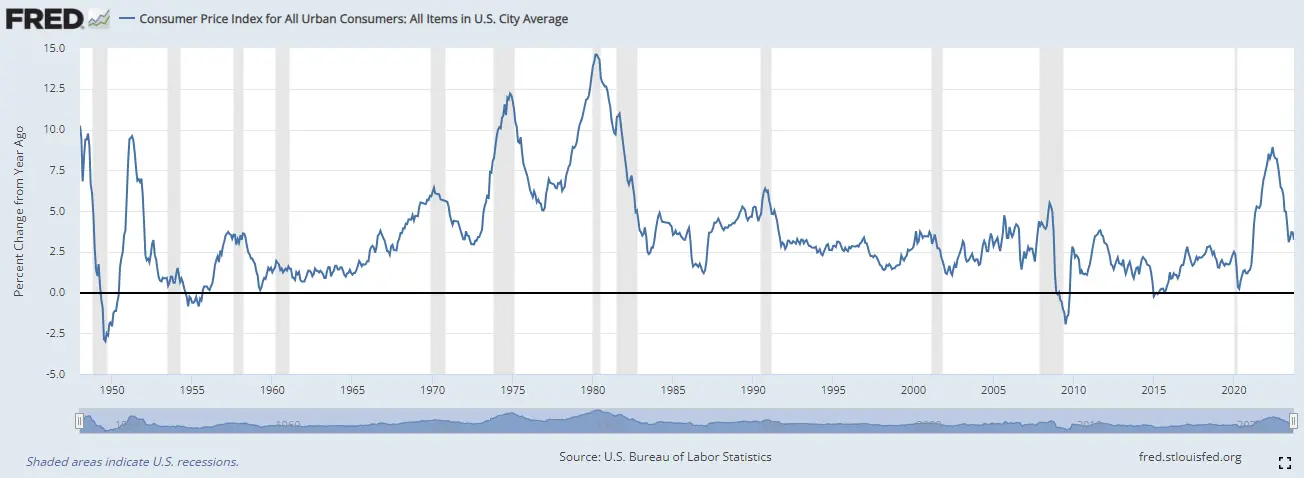

Why would the Fed pivot in the year ahead? Firstly, inflation has come down significantly, the Consumer Price Index (CPI) year on year having come down from a peak of 8.5% to 3.2% currently.

It is still above the Federal Reserve’s target of 2% but with the trend in place, inflation is no longer the issue it was.

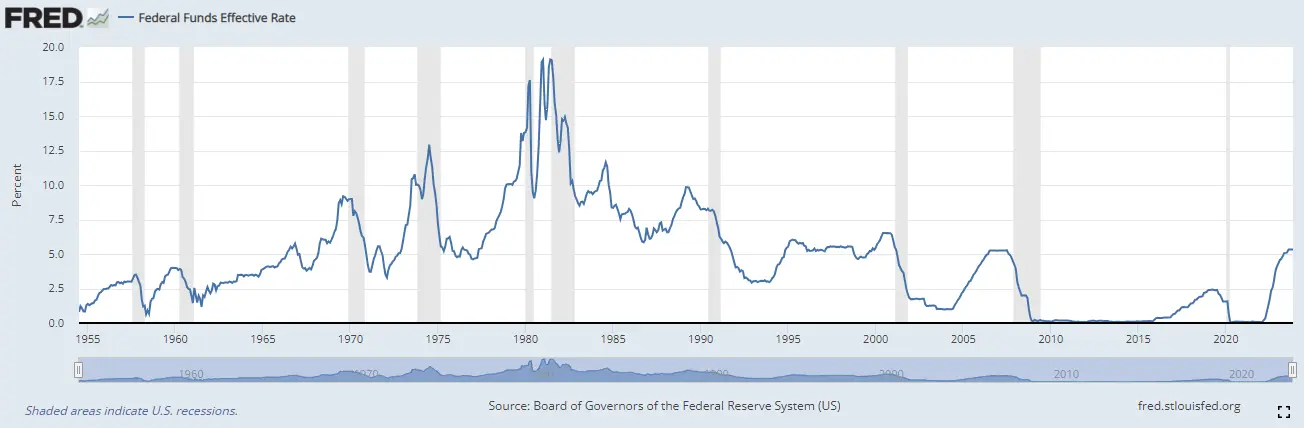

This decline in inflation was achieved by a series of interest rate hikes which have pushed the Federal Funds Rate to the highest since before the “Tech Wreck.”

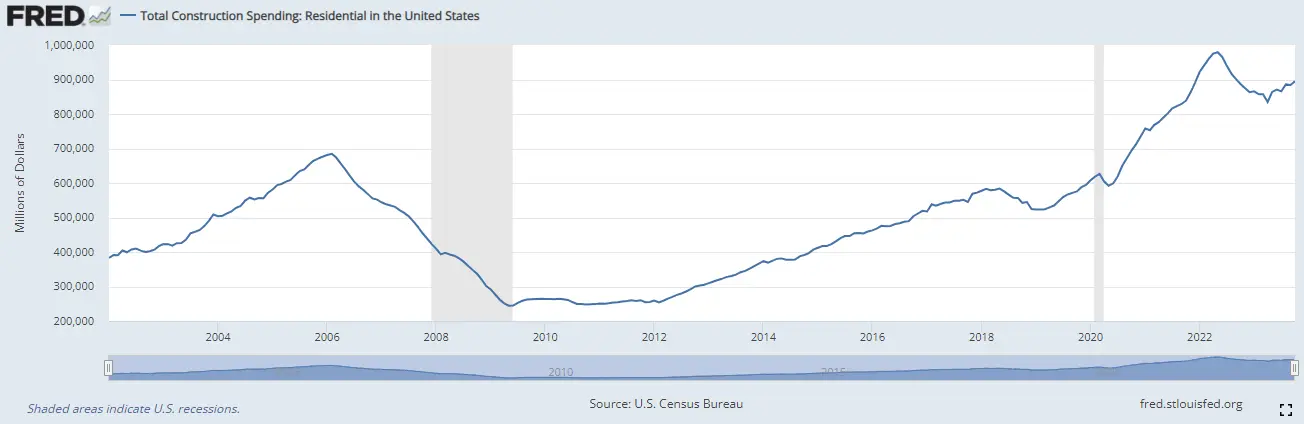

With tightening financial conditions, the fear has been that the Fed would push the economy into recession and hence face a “hard landing.” Again, in our 2023 outlook, we highlighted some of the risks on that front. One of the key sectors to watch is residential construction. This sector has historically led the economy into recession. At that time, we noted that residential construction had peaked and was in decline. Since then, however the falls have stabilised, and the threat appears to have been removed. In fact, the more recent data points have returned to growth.

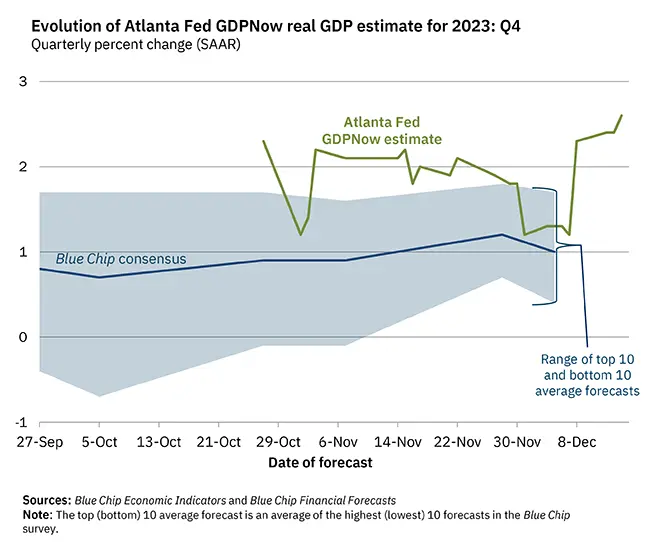

Remarkably, what we have seen is a slowdown in growth without recession. This is the exact scenario that the FOMC was aiming for. After several quarters of sub-trend growth, we saw a spike in Q3, and in Q4, GDP growth is set to be but positive again at a 2.6% annualised rate.

Now by shifting the interest outlook from one of tightening to one of potential cuts, the FOMC is indicating that they are prepared to support should the economy soften. This is a big shift in their narrative and has led to a rally in asset markets as long term interest rate expectations have fallen and unwound the bond spike we saw in September and October.

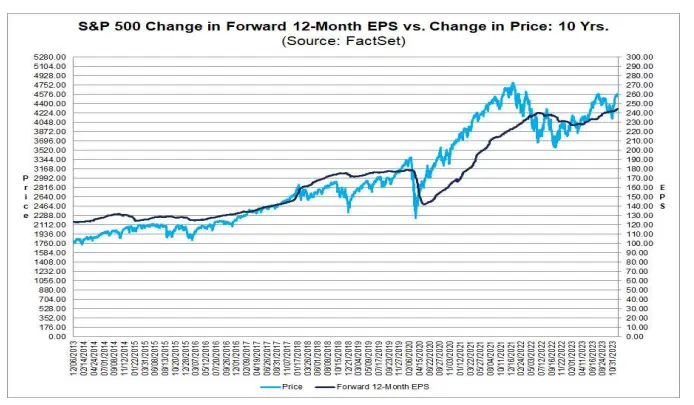

A similar picture to economic growth has occurred within the equity market. Earnings shown by the black line declined slightly in the first part of 2023 but has recovered since. The S&P500 returns show a similar picture.

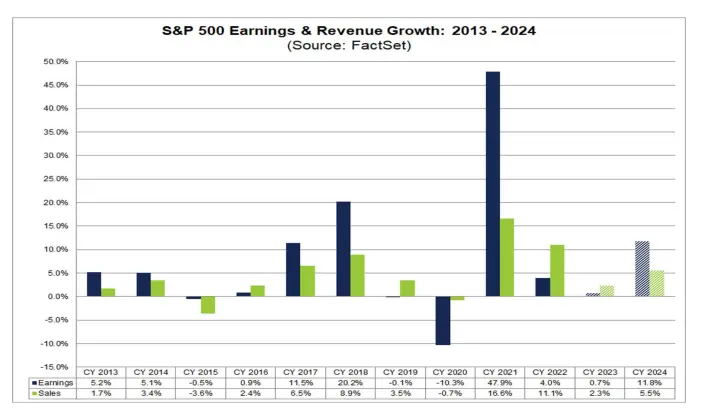

Overall, earnings are basically flat for the year. Ahead of the Q4 reporting season, total expectations are for earnings growth of 0.7% for the year. The interesting part is that a bounce back to 11% growth is expected in 2024, with expectations buoyed by the current economic conditions.

This has led to a perfect scenario for equity markets, with long term bond yields and hence, discount rates, dropping on the pivot expectations, combined with better earnings growth expectations leading to the start of what could be a good Christmas rally.

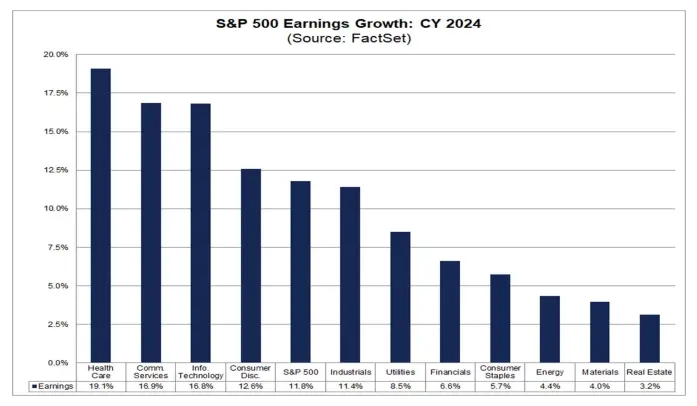

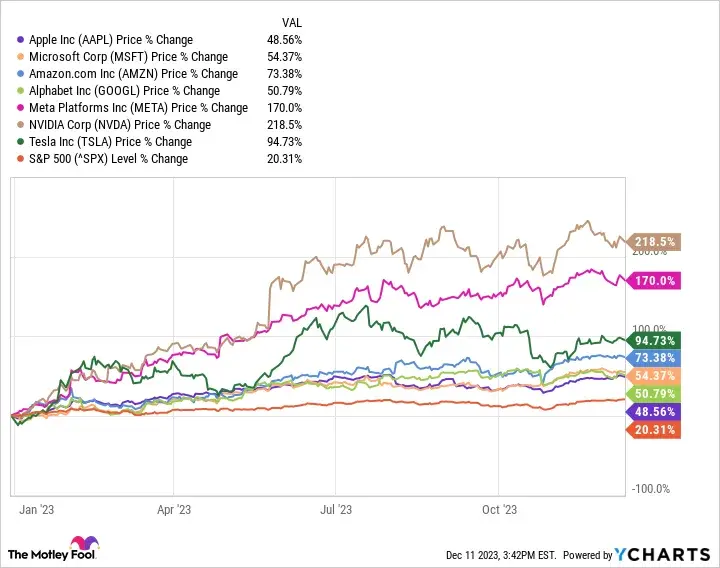

The expectations for earnings growth next year are broad based. This is important given the concentration of returns within the “Magnificent Seven” this year.

The “Magnificent Seven” are Nvidia, Apple, Microsoft, Amazon, Alphabet, Meta Platforms, and Tesla. In 2023, these seven stocks have significantly outperformed the market and have largely driven the gains of the S&P500. Nvidia has led the charge on the back of expectations in the growth of AI technology, with their shares up 218.5% year to date.

We wrote about the early stages of an AI bubble forming earlier this year, and this rally could well continue. However, for a sustained bull market, we believe it will be necessary for other sectors to drive the market higher in 2024. This in turn relies on earnings and the economy. The signs at this stage are that the FOMC have managed to tame inflation without pushing the economy into a recession, hence have they achieved the near impossible “soft landing.” We will know for certain whether this is the case in 12 months’ time; if it is the case, we can expect a solid year with respect to investment markets.